Euler Emerges as One of 2025’s Fastest-Growing DeFi Projects

0

0

Euler has had a strong run lately. Since the beginning of 2025, its lending protocol has been expanding rapidly, and the numbers show it. A little over a year ago, back in early 2024, its total value locked was sitting at around $100 million. Now, it has exploded past $500 million, a fivefold jump. And it is not just that—Euler’s active loan portfolio has also nearly tripled, hitting $290 million. The growth has been clear, and there is no sign of easing.

A big reason behind this surge has been the V2 upgrade, which launched six months ago. Ever since then, activity has been climbing. One stat that really stands out is protocol fees. In late 2024, Euler was making around $76,000 a month in fees. Fast forward to March 2025, and that number has already crossed $1.3 million, which is a major leap in revenue over a very short period.

Of course, Aave is still the dominant name in DeFi lending, sitting on a massive $17 billion TVL. But Euler is doing things differently. Instead of just offering the usual lending pools, it allows users to create their own lending markets, and this approach seems to be working.

At the center of Euler’s system are its Credit Vaults. These are basically lending pools, but with a flexible design. Some of them are isolated and simple, while others are cross-collateralized, meaning people can use multiple assets within the same vault. As long as borrowers provide enough collateral, they can take out loans based on the vault they are using.

There are two types of vaults on Euler. Some are governed, meaning they have a risk curator who can step in and adjust settings when needed. Others are ungoverned, which means once they are set up, no one can change them—no matter what happens in the market. That might sound risky, but for some users, having fixed rules can actually be a good thing.

Euler is not the only one going in this direction. Morpho, another protocol with $3 billion in TVL, has also been getting attention for its custom lending markets. More projects are clearly exploring this model, and it would not be surprising if this type of lending structure becomes a bigger trend in DeFi.

At the same time, Euler is not just sitting back and relying on its tech. The team has been expanding aggressively since launching V2. A bunch of projects—like Usual, Flower.Money, Twyne, Superlend, and Objective Labs—have already been built on top of Euler. And they are not stopping there. The team has made it clear that multi-chain expansion is a big focus for 2025. Right now, Euler is live on Ethereum, Base, Swellchain, SONI, BOB, and Berachain. More chains are lined up, including Unichain and Avalanche.

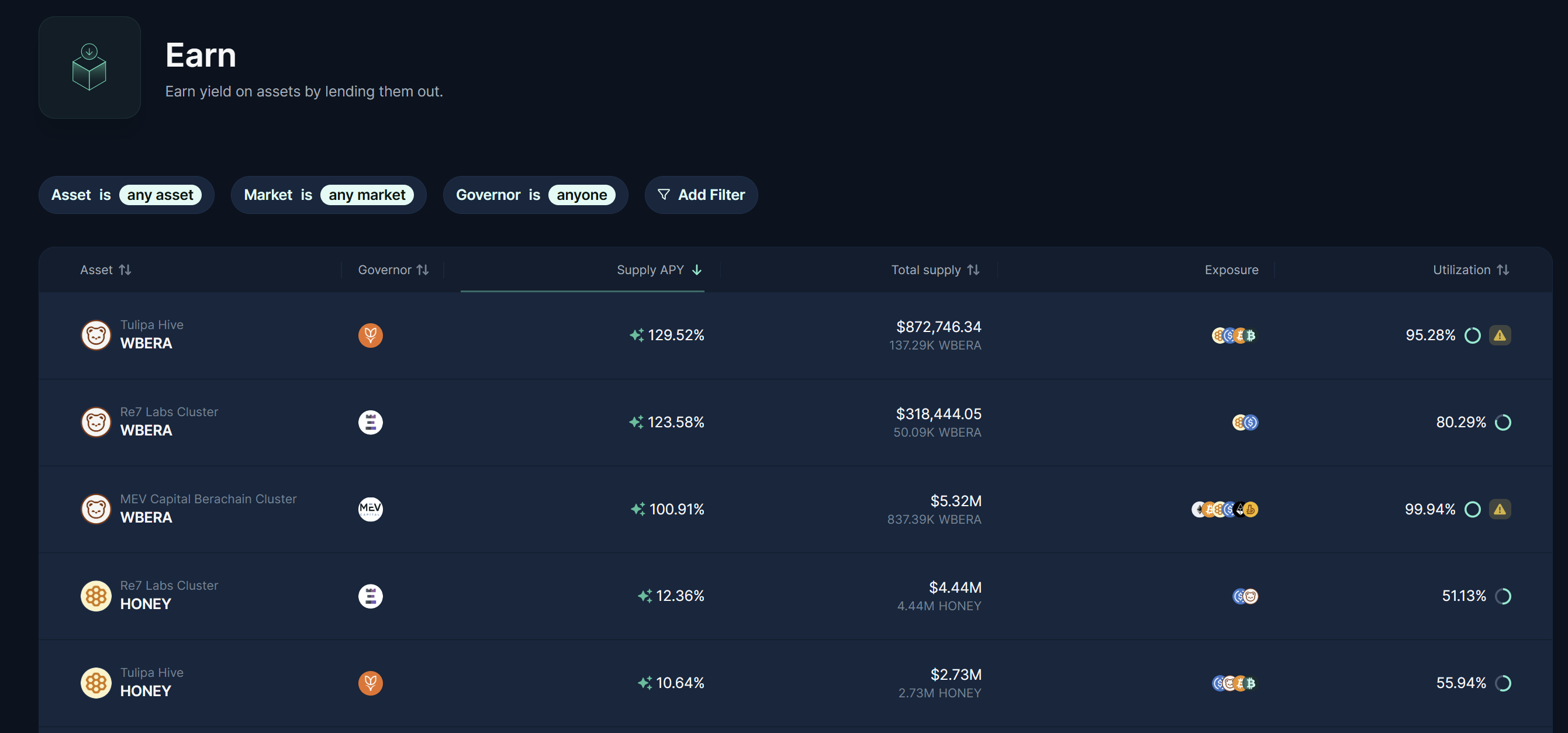

To keep attracting liquidity, Euler is also offering some pretty strong incentives. Right now, BERA holders, for example, can earn a huge 129% APY just by depositing their tokens. Naturally, deals like that bring in a lot of users, which helps boost the protocol’s TVL.

Security has been a huge focus for Euler, and for good reason. In March 2023, the project was hacked, and it was not just a small breach—it was a $197 million hit. Luckily, the team managed to recover the stolen funds, but that kind of event sticks with you.

Since then, they have gone all-in on security, spending millions every year on audits. Right now, they have set aside a $4 million budget just for security alone. Before launching V2, they didn’t take any chances, bringing in 13 different firms to review the code—not just once, but a total of 45 times. Most DeFi projects don’t go that far, but after what happened in 2023, it is not surprising they are being extra careful.

Euler’s token has been performing well lately. It is currently sitting at a $124 million market cap, and its price has already doubled since late 2024. If the protocol keeps growing and TVL keeps climbing, there could be even more upside. But, as always, it all depends on how the market moves in the coming months. We will continue to Observe.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.