Bitcoin ETFs See Fifth Consecutive Day of Inflows, BlackRock’s IBIT on Top

0

0

Highlights:

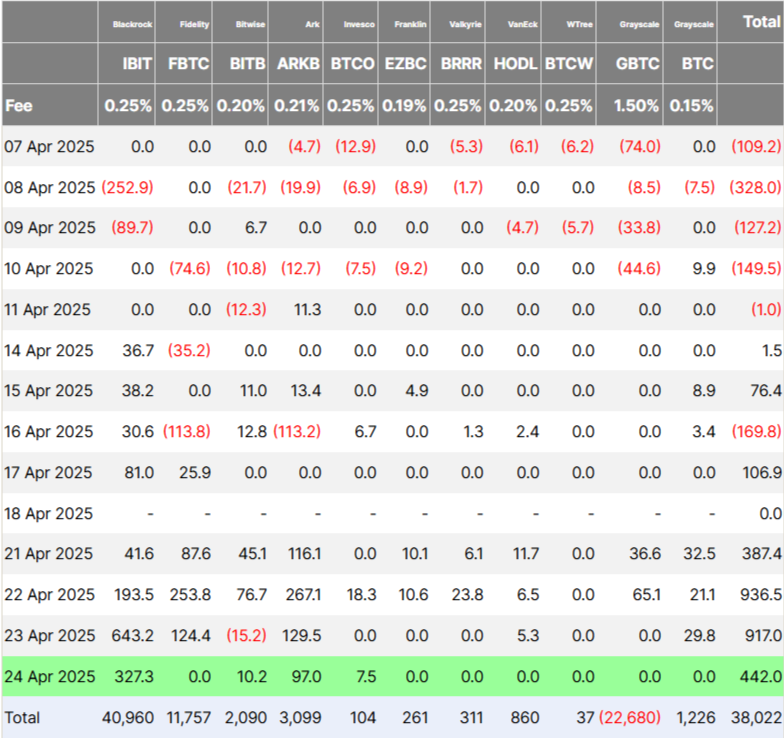

- Bitcoin ETFs saw a $442M inflow on Thursday, marking their strongest weekly performance since December.

- BlackRock’s IBIT led inflows with $327.3M, maintaining dominance among Bitcoin spot ETFs.

- BTC price and open interest both rose, signaling increasing investor confidence and activity.

US-based spot Bitcoin (BTC) exchange-traded funds (ETFs) continued their strong performance yesterday, attracting $442 million. This was the fifth straight day of positive inflows for the Bitcoin ETF sector. The ongoing inflows occur alongside a modest market rebound observed over the past 24 hours. The recent inflow brought the total for the week to $2.68 billion, marking the highest weekly net inflow since the first week of December.

Bitcoin ETFs Attract Massive Inflows Amid Market Resilience

On April 24, BlackRock’s IBIT, the largest spot Bitcoin ETF, led the way with $327.3 million in inflows, according to Farside data. Meanwhile, Ark and 21Shares’ ARKB saw net inflows of $97 million, Bitwise’s BITB registered $10.2 million, and Invesco’s BTCO garnered $7.5 million. Thursday’s $442 million in inflows followed large inflows of $917 million on Wednesday and $936.5 million on Tuesday. However, the total trading volume across the BTC ETFs dropped to $2 billion on Thursday, down from $4 billion the previous day.

The five-day streak of inflows coincided with Bitcoin’s continued strength. This resilience came amid broader market uncertainty, fueled by ongoing global trade tensions. On Thursday, major U.S. stock indexes finished higher. Investors were closely monitoring developments in the U.S.-China tariff disputes. The Nasdaq Composite gained 2.6%, the S&P 500 rose 2%, and the Dow Jones Industrial Average climbed 1.2%.

The crypto market has experienced a slight rebound over the past 24 hours, with BTC’s price rising by 1%. During the same time frame, open interest in BTC futures has also increased, indicating a small rise in investor demand. Currently, open interest is at $65 billion, reflecting a 1% increase today.

This gradual uptick in BTC’s price and open interest reflects growing market participation and confidence in the current trend. This simultaneous rise suggests new positions are being opened to support the price movement, which is seen as a bullish sign.

Michael Saylor Predicts BlackRock’s IBIT Could Be the World’s Leading ETF in 10 Years

During the Bitcoin Standard Corporation’s Investor Day in New York on April 24, Michael Saylor, Executive Chairman of Strategy Inc., spoke to a packed audience of institutional investors and business leaders. He confidently forecasted that BlackRock’s BTC ETF would become the largest ETF in the world within ten years. His confidence stemmed from BlackRock’s strong and growing involvement in Bitcoin.

Since launching on January 11 last year, IBIT has gathered over $54 billion in net assets. It hit $10 billion in just seven weeks, becoming the fastest-growing ETF ever. This rapid rise made IBIT the largest BTC ETF. It has overtaken both Invesco QQQ Trust and Fidelity’s Bitcoin Fund, which hold $18.3B and $19.68B. Spot Bitcoin ETFs now hold over 1 million BTC worth more than $95 billion. IBIT alone commands 48.7% of the United States Spot Bitcoin ETF market.

NEW: @saylor predicts that @BlackRock’s $IBIT will be “the biggest ETF in the world in ten years.” pic.twitter.com/cyDDFf47FV

— Eleanor Terrett (@EleanorTerrett) April 24, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.