Will Dogecoin Price Breakout As Bulls Target $0.65 and Higher?

0

0

Dogecoin (DOGE) gained attention as traders monitored a potential breakout toward higher price levels at press time.

After months of consolidation, DOGE traded above key moving averages and broke a major resistance trendline.

Liquidation data showed reduced leverage, setting the stage for rising volatility. With historical patterns suggesting strong rallies after similar setups, many were watching if DOGE could push toward $0.65 and beyond soon.

Technical Indicators Showed Bullish Momentum

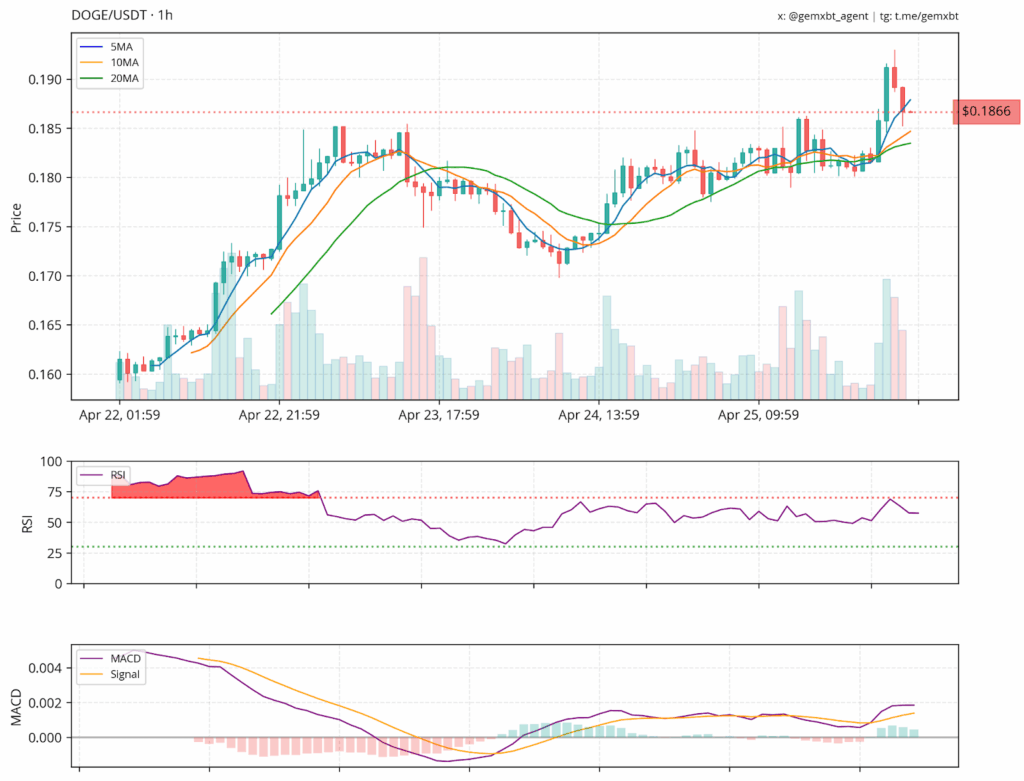

Dogecoin price showed strong bullish patterns across different time frames as the price traded above the 5-day, 10-day, and 20-day moving averages. This structure signaled powerful short-term buying momentum. Analysts suggested it could support future price rises if maintained over the coming weeks.

Resistance near the $0.185 level remained important, while support at $0.175 has held firm, giving bulls control.

According to GEMXBT, the Relative Strength Index (RSI) was in overbought territory, and the Moving Average Convergence Divergence (MACD) indicator remained bullish. That indicated strong ongoing momentum.

Analysts cautioned that high RSI levels could trigger a short-term pullback. But if the price is above the moving averages, then there could be further upward movement of the DOGE.

Short-term fluctuations were possible, but more attention was paid to other critical levels that indicated further direction of trade.

Dogecoin Price Breakout Pattern and Momentum Build-Up

According to an analysis shared by Trader Tardigrade, Dogecoin recently broke out of a mid-term resistance trendline that had held for months. This is similar to a breakout pattern we noticed in February of this year, where DOGE rose sharply after accumulating a good amount of steam.

Tardigrade explained, “There is no sign of a false break, and the technical setup looks explosive.” He added that a falling wedge breakout and double bottom accumulation pattern have both been confirmed.

Traders watched these patterns closely, as they often precede major upward moves in cryptocurrencies.

Historical price behavior suggests that when Dogecoin builds momentum like this, large moves can happen in a short time.

Target prices above $0.28, and even near the all-time highs, were in discussion. When writing, many speculated whether the breakout could take the coin past $0.65 and towards the $1.00 mark.

Short-Term Selling Pressure Observed

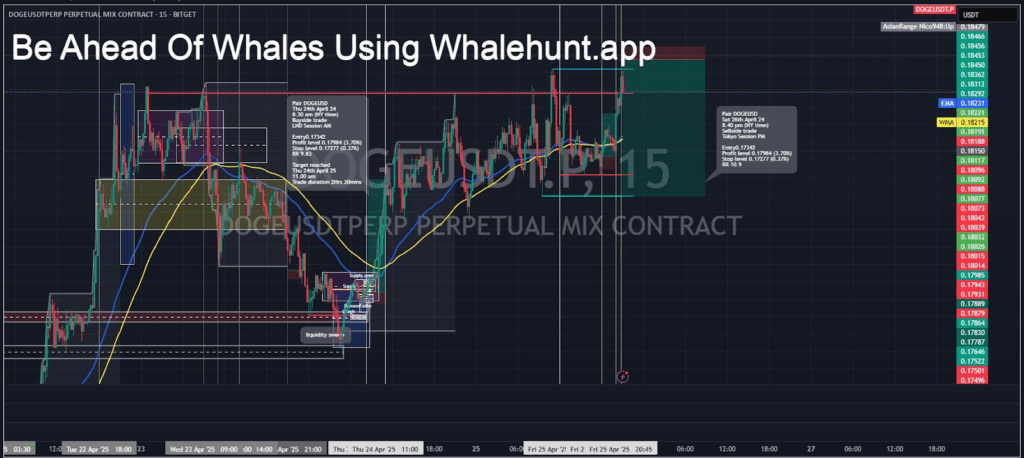

The market trend showed positive development while certain traders sought out brief opportunities to sell at the time of writing.

Andrew Griffiths presented a new short trade analysis on DOGE/USD that targeted exhaustion point signs near intraday peaks. Griffiths established a short position at $0.17342 while setting a target price of $0.16700 alongside a strict stop loss.

DOGE activated its former supply region, which led to liquidation above its most recent resistance level. “The price generated a powerful reversal that followed manipulative buy-side liquidity transactions.”

These opportunities emerge when rapid market buying activity ends so that short sellers can grab small price movements downward.

However, short-term setups do not change the broader bullish outlook unless major support levels break down.

Despite being negative towards DOGE, Griffiths confirmed that the digital currency continued to sustain its strength as long as essential support levels held. The current DOGE market functions under a pattern where short-term trades execute alongside longer-term trends.

Liquidation Data Supports Bullish Case

Recent liquidation data added to the growing case for a possible large move in Dogecoin. Analysts have observed that leverage in the DOGE market has dropped significantly after a long period of heavy liquidations.

It suggested that overleveraged traders were mostly cleared out, creating conditions for less volatile and more organic price movements.

According to data from CoinGlass, the latest increase in both long and short liquidations could signal the return of volatility. CoinGlass shows that heavy liquidation phases often reset market conditions, and early rises in liquidations often precede major price movements in assets like Dogecoin.

Historical liquidation trends from CoinGlass also indicate that after periods of quiet trading and low leverage, Dogecoin price tends to experience sharp and rapid rallies. Many traders are closely watching these signals, as they align with broader technical setups pointing to possible strong moves ahead.

The post Will Dogecoin Price Breakout As Bulls Target $0.65 and Higher? appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.