😎 Your Peachy Solana Summer

0

0

GM, and welcome to another edition of CoinStats Scoop! 🥂 In this week’s newsletter, you'll find:

The usual market overview featuring another relatively slow week

Weekly updates on noteworthy news and developments

Highlights of Solana's glowing future

Reads about institutional demand for crypto

Tweets & Memes capturing last week’s crypto highlights

Weekly wrap-up: predictions & takeaways.

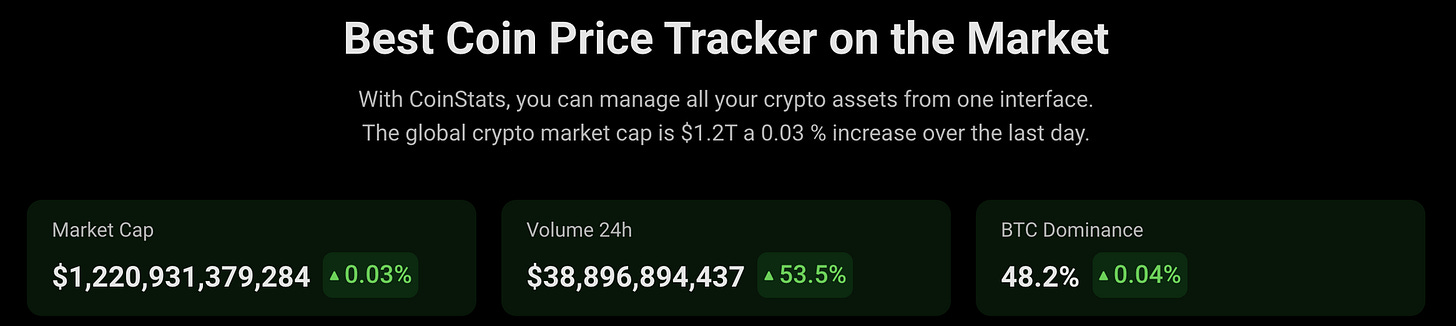

Market Overview

While we’ve successfully completed another uneventful week, it was relatively calm in the crypto world, likely due to the United States holiday last Tuesday. As a result, BTC remained relatively stable at around 30.3k, while ETH experienced a slight decline, relinquishing some of its recent gains and closing the week at ~1870.

Once again, the crypto market's king displayed its strength as most alts (alternative cryptocurrencies) and ETH underperformed compared to Bitcoin. In most cases, when BTC and ETH go up, it usually signals a potential expansion for alts as well. However, the opposite scenario played out this week, with BTC experiencing a negligible loss of less than one percent, while both ETH and alts retraced some of their recent gains.

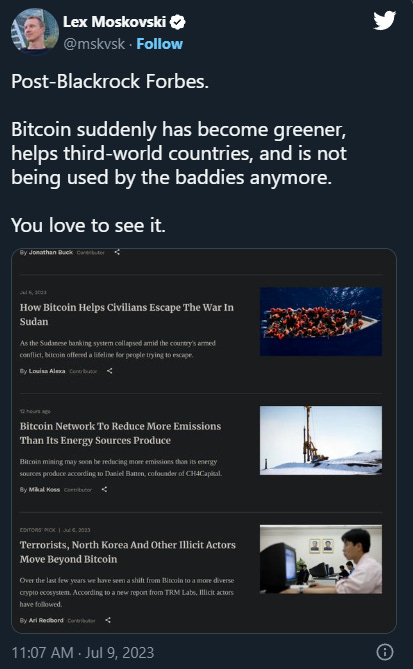

Contributing to BTC's relative strength is the highly anticipated ETF. Previously, institutional investors faced challenges accessing BTC, but the world's largest asset manager BlackRock's involvement, could potentially pave the way for increased institutional flows into BTC, bolstering its position in the market. 🤑

In the video, the CEO of the world's largest asset manager expressed his view that Bitcoin is "digitizing gold" and referred to crypto as an "international asset." While these statements may seem like mere sayings from a live interview, their impact on the United States and the global asset management sector is substantial. 💪 The public endorsement of Bitcoin and cryptocurrency by the BlackRock CEO carries immense weight, signaling a growing acceptance and recognition of these digital assets within the financial industry.

Despite the overall sluggish market conditions, SOL (+8%), the alternative Layer 1, once again outperformed, continuing to battle back from recent lows. 😤 Rolllbit (RLB, +65%) was another best-performing token. Facilitating the transition from SOL to ETH, RLB has been gradually and accurately repriced as an exchange token!

News & Developments

Hidden Road, the global credit network for institutions, has been granted a Crypto Service Provider registration by the Dutch Central Bank

dYdX (DYDX), one of the most popular decentralized exchanges, releases v4 of its testnet, continuing its transition from ETH to an ATOM-based appchain

Circle, the issuer of USDC, crypto’s second largest stablecoin, announces the launch of programmable Wallets-as-a-Service, enabling developers to embed secure wallets in their app in minutes

Arbitrum, the project with the highest TVL in Ethereum's Layer 2 scaling solution, votes to lock 700 million ARB tokens worth $770 million+ in a vesting contract

IDEX, a new upcoming decentralized exchange, announces a partnership with Polygon’s MATIC to create XCHAIN, a zero-knowledge L2 dedicated to serving the IDEX ecosystem

The Blackrock CEO, the world’s largest asset manager, who was previously skeptical of crypto, calls Bitcoin “digitizing gold” and crypto an “international asset” in an interview

OpenSea, the largest NFT marketplace, now supports NFTs on Zora’s ETH Layer 2 network

Solana Summer

As the bear market persists, Solana has been steadfast in rebuilding its brand, reputation, developer base, and community. Despite some prematurely writing off SOL following the collapse of FTX, a dedicated team of developers, committed team members, and a supportive community have remained resolute in their belief that SOL will endure in the long run.💪

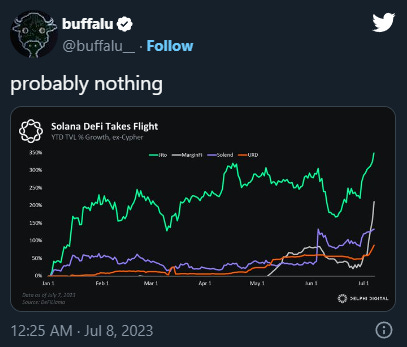

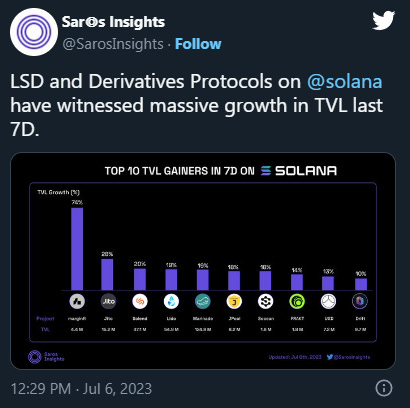

In addition to SOL's recent impressive performance and resilience, each passing day brings greater clarity to its bright future. SOL not only continues to outperform major cryptocurrencies like ETH and BTC but also boasts a burgeoning DeFi ecosystem complementing its already strong NFT ecosystem.

This tweet highlights the recent growth of SOL's DeFi ecosystem, with notable protocols such as Jito, MarginFi, Solend, and UXD experiencing impressive expansion in recent weeks. Particularly noteworthy is Jito, which has emerged as a leader in the recovery of SOL's DeFi space. Jito's growth not only demonstrates its own impressive trajectory but also draws parallels to the growth of the Ethereum liquid staking ecosystem. Jito is a liquid staking protocol on SOL, and its recent growth provides a positive signal for recovering the SOL DeFi ecosystem. As the entire crypto sector continues to recover and gradually trend upwards, SOL has positioned itself to become a token that enters discussions alongside established players like ETH and BTC.

Blockworks, one of the most respected crypto news and research publications, has also acknowledged SOL’s recovery, with Dan Smith tweeting about Solana DeFi's resurgence!

Read of the Week

This week, our read comes from none other than the researchers at Binance. Their “Institutional Crypto Outlook Report” provides an amazing overview of the crypto ecosystem. While the report provides a detailed and extensive analysis, its core takeaways are succinct and evident. Institutions that have previously embraced cryptocurrencies are predominantly either maintaining or increasing their positions in crypto assets. 😤

Here are the report's key takeaways:

When investors were asked about their outlook for the next decade, an overwhelming majority (88%) expressed a positive sentiment, indicating their optimism toward the future of crypto

Looking ahead, the majority of respondents (50%) anticipate increasing their allocation to crypto, while only a small fraction (4.3%) expect to reduce their allocation in the next 12 months. These statistics imply that approximately 96% of the respondents are planning to increase their exposure to cryptocurrencies in the future

Institutional investors continue to focus their attention on key areas such as infrastructure, Layer 1 (L1) blockchains, and Layer 2 (L2) scaling solutions

“Institutional investors believe more real-world use cases and improvements in regulatory clarity will help drive crypto adoption”

“63.5% of respondents indicated that they are positive about the outlook of crypto over the next 12 months”

“Institutional investors are generally optimistic about the outlook of the crypto market.”

Tweets & Memes

The concept and message behind Bitcoin and the broader crypto industry are gradually becoming clearer. 😤

Pentoshi provides a helpful thread on navigating the crypto markets 💪

Even with the recent focus on US politics, it's essential to recognize that crypto is a global movement 💪

After a long wait, the CEO of the world’s largest asset manager embraces BTC 🤓

Wrapping Up

With the tweet highlighting the world’s largest asset manager embracing Bitcoin and crypto at large, we’ll conclude this week’s edition of the CoinStats Scoop! 💫

As usual, we provided the regular market update and walked through a relatively slow crypto week, once again highlighted Solana’s bright future, with SOL outperforming ETH and BTC, read about the institutional demand and positioning from Binance’s survey, and covered the weekly news and developments. 💪

CoinStats will continue to guide you through the world of crypto and DeFi. We'll see you next week for another edition of CoinStats Scoop! 😎

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.