What to expect from Ethereum (ETH) in May

0

0

After a relatively flat April marked by decreased network demand and sideways price action, the second-largest cryptocurrency, Ethereum (ETH), may be positioned for a shift.

ETH holders are optimistic about May. This optimism is fueled by strengthening fundamentals, the anticipated Pectra upgrade, and renewed interest from institutional investors through spot ETH exchange-traded funds (ETFs).

ETH Struggled in April, but May Brings a Glimmer of Hope

In April, on-chain data showed a dip in user activity across the Ethereum network, while broader market stagnation kept ETH trading below key resistance levels.

According to Artemis, during the 30-day period, user demand for Ethereum plummeted, leading to a decline in the number of active addresses, daily transaction count, and consequently, its network fees and revenue.

This and the broader market downturn impacted ETH’s performance, causing the leading altcoin’s price to remain below the $2,000 mark throughout April.

However, in an interview with BeInCrypto, Gabriel Halm, a research analyst at IntoTheBlock, said that ETH’s price could break above the $2,000 price mark in May and stabilize above it.

For Halm, the improved capital inflows into ETH spot ETFs, Ethereum’s dominance in the coin’s decentralized finance (DeFi) vertical, and its upcoming Pectra upgrade could help bring this to fruition.

ETF Inflows, DeFi Dominance, and Pectra: Triple Boost for Ethereum in May

According to SosoValue, monthly net inflows into ETH ETFs totaled $66.25 million in April, signaling a shift in market sentiment compared to the $403.37 million in net outflows recorded in March.

Total Ethereum Spot ETF Net Inflow. Source: SosoValue

Total Ethereum Spot ETF Net Inflow. Source: SosoValue

This reversal from heavy outflows to modest inflows suggests that investor confidence in the altcoin is gradually returning. It indicates that institutional players may be positioning for a longer-term rebound, especially as Ethereum’s network fundamentals begin to improve, one of which is its climbing dominance in the DeFi sector.

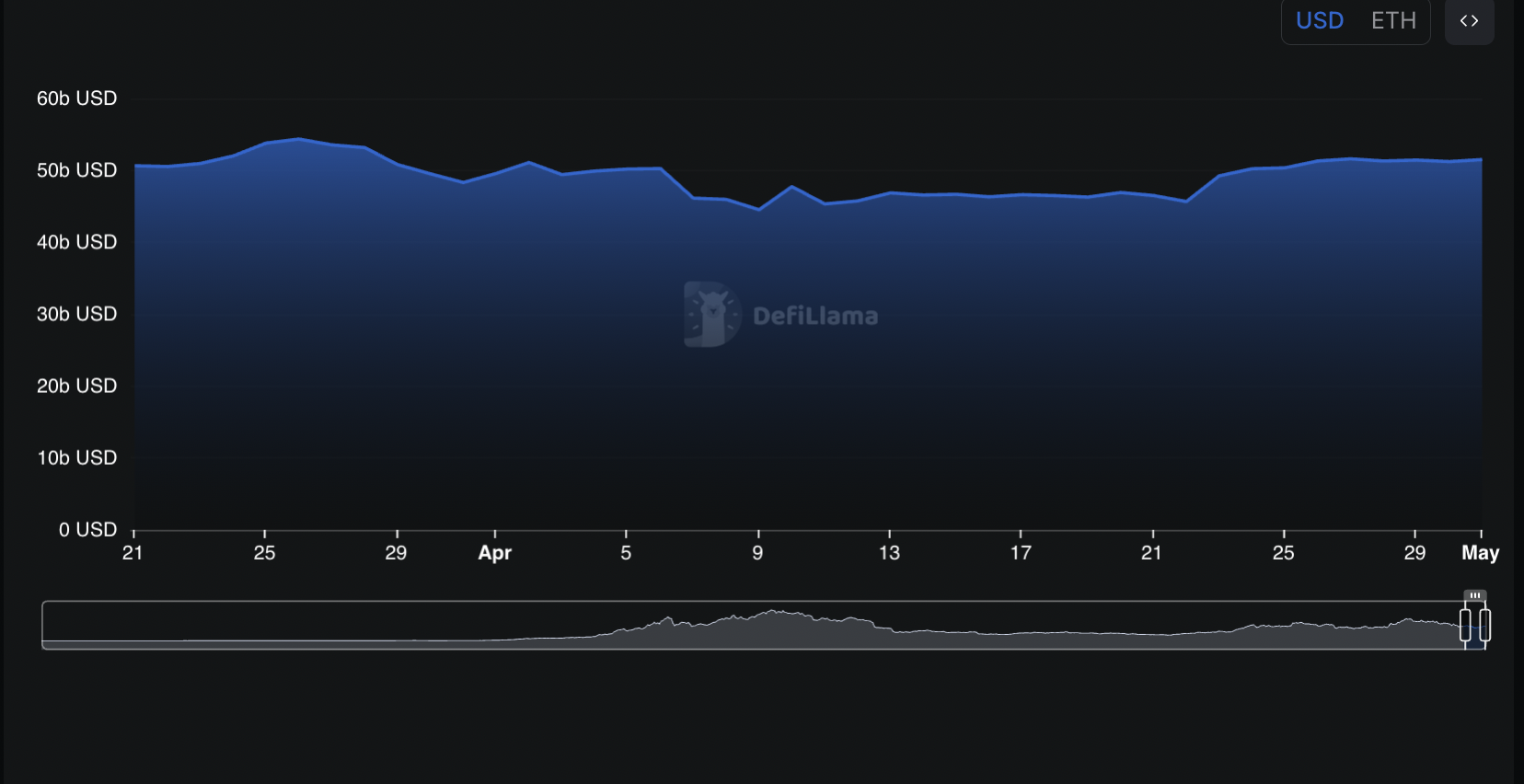

Over 50% of the total value locked (TVL) in DeFi protocols still resides on the Ethereum blockchain. This means that the Layer-1 (L1) remains the preferred settlement layer for various financial applications, including lending, staking, yield farming, and decentralized exchanges.

Ethereum’s DeFi TVL. Source: DefiLlama

Ethereum’s DeFi TVL. Source: DefiLlama

Therefore, in May, if broader market conditions begin to improve, renewed capital inflows into Ethereum’s DeFi sector could, in turn, drive up demand for ETH and support its price rally.

Moreover, according to Halm, Ethereum’s upcoming Pectra upgrade, set to launch on May 7, 2025, could further aid ETH’s price performance this month. The upgrade promises to enhance the network’s scalability, reduce transaction fees, improve security, and introduce smart account functionality.

These improvements may fuel a surge in user demand throughout May, potentially lifting ETH’s price, provided macroeconomic conditions remain favorable.

ETH’s Growth Hinges on Broader Market Stability

Despite this, the broader economic pressures pose a significant risk to ETH in May. Halm noted that “the upcoming CPI report on May 13th will be particularly important, potentially influencing market sentiment and contributing to this volatility.”

This is because inflation or hawkish signals from the Federal Reserve could worsen the risk-off sentiment in the crypto market, putting pressure on ETH’s price.

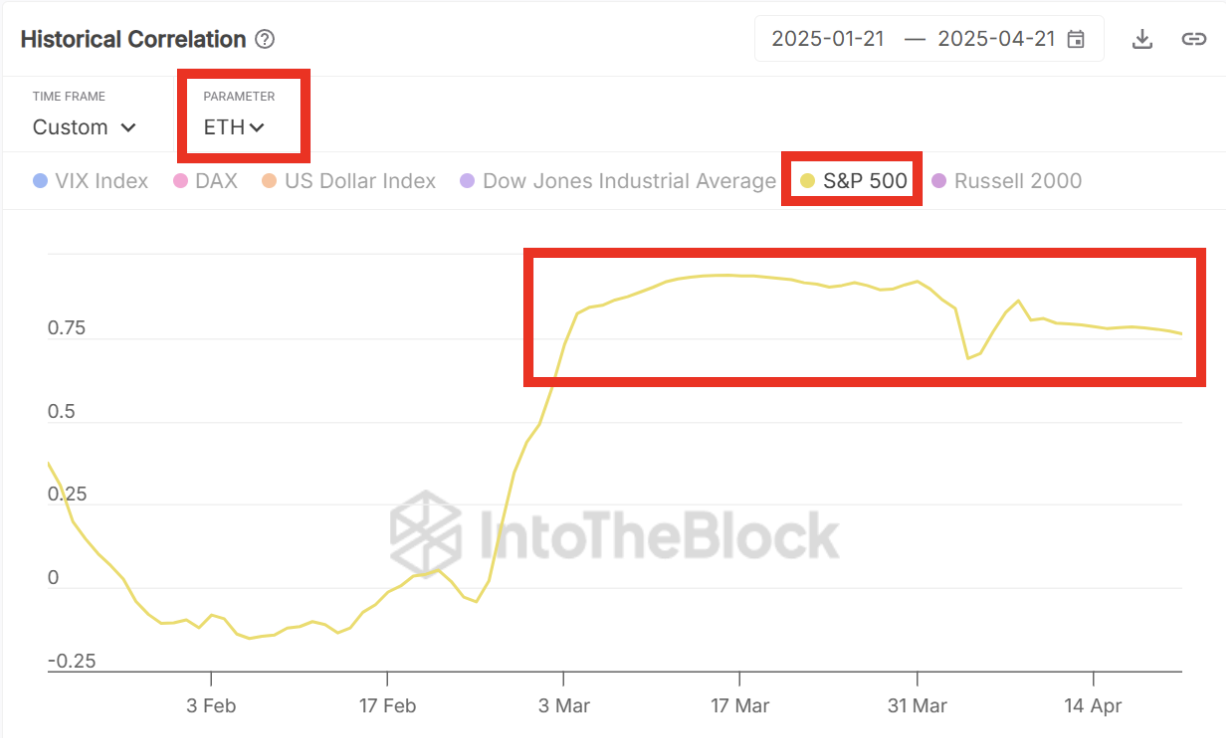

Halm also pointed out that ETH’s price remains tightly correlated with US equities. Therefore, if equity markets face renewed stress this month due to inflation fears or rate hike expectations, the altcoin may come under similar pressure.

ETH’s Historical Correlation to S&P 500. Source: IntoTheBlock

ETH’s Historical Correlation to S&P 500. Source: IntoTheBlock

“Looking ahead to May, if this high correlation persists, it implies that Ethereum’s vulnerability to market downturns and inflation-related pressures would likely be similar to that of traditional risk assets like those in the S&P 500. A downturn in the general market or increased concerns about inflation impacting equities could therefore negatively affect ETH’s price,” said Gabriel Halm, research analyst at IntoTheBlock,

While a sustained push above $2,000 remains possible, any rally will likely depend on inflation trends, risk sentiment in traditional markets, and how tightly ETH remains tied to equities.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.