XRP Price Hits a Multi-Month High as SEC Greenlights Pro Shares XRP ETF – Is $3 Plausible?

1

0

Highlights:

- XRP price has rallied 6% to hit a multi-month high of $2.35.

- This comes as the SEC approves the ProShares Trust XRP ETF.

- CoinGlass data shows a volume and open interest spike, indicating a potential rally to $3 in XRP.

The XRP price has broken out of a descending parallel channel, hitting a multi-month high at $2.35, a 6% surge in the past 24 hours. Moreover, other leading altcoins, such as Bitcoin, keep knocking at the $95K mark, as investors are optimistic about a potential rally. The recent surge in the cross-border payment token (XRP) comes following the SEC’s green light of Proshares XRP ETF set for April 30.

The SEC has given approval for ProShares Trust's $XRP Futures ETF for an April 30 launch date. Although not Spot, it marks the first strictly Futures ETF for Ripple's XRP token in the US

pic.twitter.com/ORVTpi3tms

— ALLINCRYPTO (@RealAllinCrypto) April 27, 2025

However, the recent ETF is not a spot ETF; it is the very first strictly futures ETF for Ripple’s token in the US. This has fueled optimism in the XRP market, with various analysts and investors pointing to a possible road to $3. Ali Martinez states that ”the XRP price is set for an inverse head-and-shoulders pattern breakout, toward $2.70-$2.90.”

$XRP looks to be breaking out of an inverse head and shoulders pattern, with a potential upside target between $2.70 and $2.90. pic.twitter.com/TXjQ6zhnND

— Ali (@ali_charts) April 28, 2025

XRP Price Outlook

Looking at the XRP daily chart, the cross-border payment token seems poised for a potential upside. This is evident as the XRP price has flipped above key moving averages, indicating that the bulls dominate the market. The volume has spiked over 150%, signaling heightened market activity, which could surge XRP toward $3.

The bulls have established strong support at $2.00 and $2.18, coinciding with the 200-day and 50-day MAs. If the buying appetite sustains, XRP price could rally towards $2.54, $2.70, and $2.80. In a highly bullish scenario, the token would hit $3.

Moreover, technical indicators such as the Relative Strength Index indicate intense buying pressure. Its position at 62, above the 50-mean level, suggests that the bulls are fully dominant. There is still more room until XRP hits the 70-overbought region. Notably, the MACD has flipped above the orange line, showing a bullish divergence. It notably shows strength as it hurtles toward the positive territory, painting a bullish picture.

On the downside, if the investors commence early profit booking, the XRP price could drop. In such a case, the $2.33 immediate support level will act as a safety net against further downside. If the selling pressure intensifies, a deeper correction toward $2.18, $2.17, and $2.08 will be in line to absorb pressure. Until then, the XRP price is bullish and remains vulnerable to the upside trajectory.

XRP On-Chain Metrics Show Positive Momentum

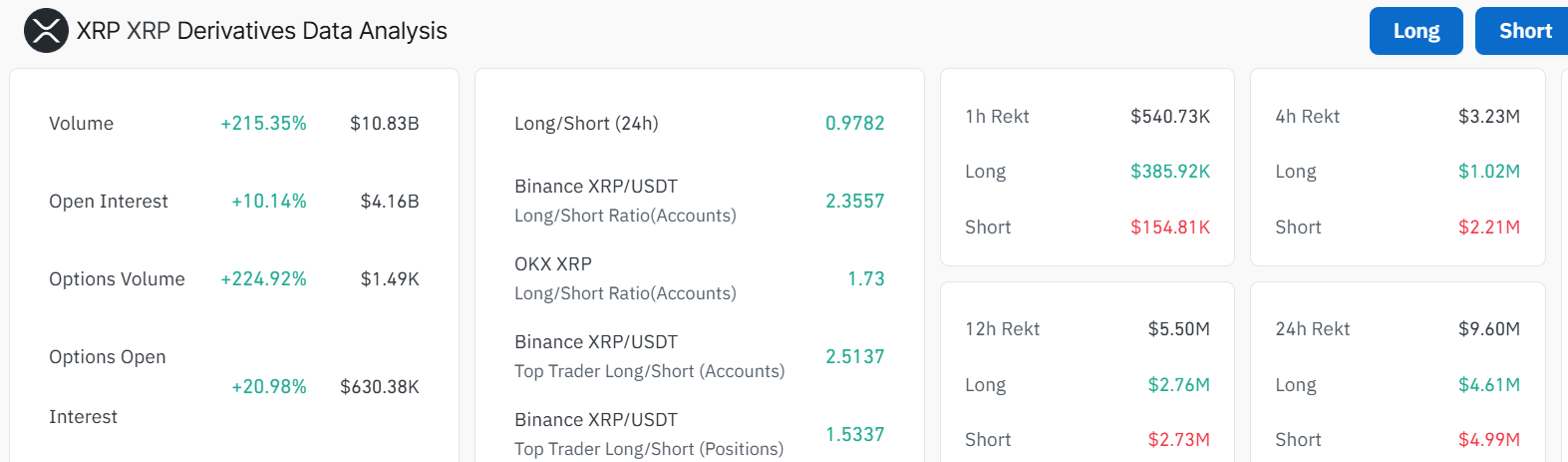

According to Coinglass data, XRP derivatives data show a positive outlook, as the open interest and volume surge. The OI has risen 10% to $4.16B, and the volume has spiked 215% to $10.83B. Moreover, the options volume is up 224% to $1.49K, and the options open interest has increased by 20% to $630.38K.

This suggests intense market activity as investor confidence in the XRP market soars. Moreover, the spike in OI and volume shows that new money is currently flowing into XRP, which may cause a rally toward $2.80 in the short term. Recent developments, such as the Pro Shares XRP ETF set to launch on April 30, could act as a catalyst for the XRP price to hit $3 soon.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.