Bitcoin and Ethereum ETF Outflows Persist Amid Market Weakness

0

0

Highlights:

- Bitcoin ETFs recorded $149.66 million in net outflows on April 10.

- Ethereum ETFs forfeited $38.79 million on the same day.

- The losses extend Bitcoin ETFs’ outflow streak to the sixth consecutive day.

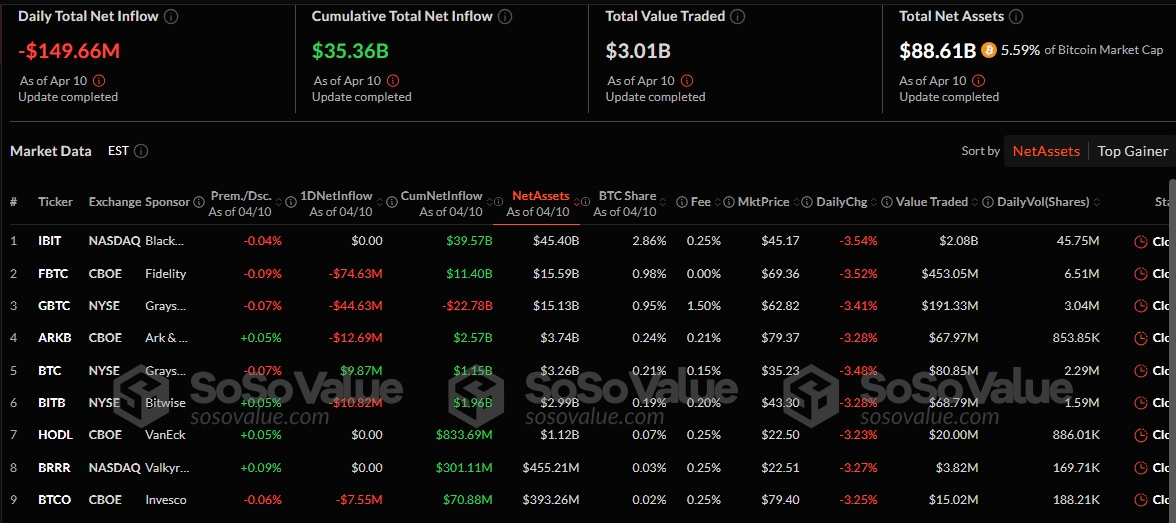

On April 10, Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs) recorded net outflows, extending their losses streak amid the crypto market weakness. According to SosoValue’s statistics, Bitcoin ETFs lost $149.66 million, marking its sixth consecutive net outflow. BTC Funds’ latest loss implies that the ETFs have not recorded any gains since this week. Also, the funds had only one net inflow this month.

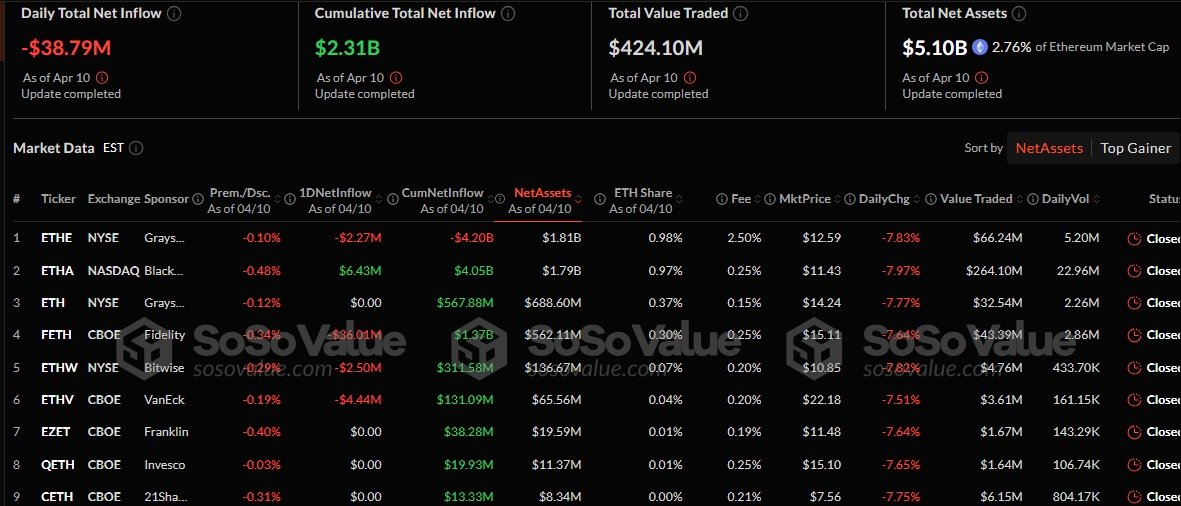

Similarly, Ethereum ETFs recorded losses of about $38.79 million, extending their consecutive net outflows to a third straight day. Like Bitcoin ETFs, Ethereum funds had only one net inflow in April. However, they recorded zero flows on April 7 and had losses in the remaining days.

On April 10, Bitcoin spot ETFs saw a total net outflow of $150 million, marking the sixth consecutive day of outflows. Ethereum spot ETFs recorded a total net outflow of $38.79 million, with outflows continuing for the third straight day.https://t.co/Hj2Gs49bWa

— Wu Blockchain (@WuBlockchain) April 11, 2025

FBTC Tops BTC ETFs Losses

Yesterday, seven ETFs were active. Six of these funds lost money, while only Grayscale Mini Bitcoin ETF (BTC) had gains worth $9.87 million. Fidelity Bitcoin ETF (FBTC) saw the highest net outflows, valued at approximately $74.63 million.

Other ETFs that suffered losses above $10 million were Grayscale Bitcoin ETF (GBTC), ARK 21Shares Bitcoin ETF (ARKB), and Bitwise Bitcoin ETF (BITB). These funds lost $44.63 million, $12.69 million, and $10.82 million, respectively. Franklin Bitcoin ETF (EZBC) and Invesco Bitcoin ETF (BTCO) also lost $9.21 million and $7.55 million, respectively.

As a result of the most recent losses, Bitcoin ETF cumulative net inflow dropped from $35.51 billion to $35.36 billion. Similarly, the total value traded depreciated from $5.3 billion to $3.01 billion. The total net assets value also dropped from $91.79 billion to $88.61 billion.

Bitcoin Record’s Slight Jump Despite Worrying ETFs Trend

At the time of writing, Bitcoin’s price is up 1.1% in the past 24 hours, trading at about $82,290. In the past week, Bitcoin’s price depreciated by about 2.7%, fluctuating between $74,773.26 and $84,430.20. BTC’s 24-hour trading volume fell 34.26% to $47.06 billion.

Despite global trade tensions, Matt Hougan, Chief Investment Officer at Bitwise, reiterated his $200,000 price prediction for Bitcoin in 2025. On April 9, he said the recent changes in US trade policy could help boost Bitcoin’s price.

Charles Hoskinson, Cardano’s founder, echoed similar claims in a recent CNBC interview. The Cardano founder predicted that Bitcoin could hit $250,000 by the end of this year or 2026. He cited Bitcoin’s growing adoption by leading tech firms and crypto-friendly regulations as the token’s price ascent driving factors.

Bitcoin to hit $250,000 this year and Magnificent 7 to adopt stablecoins, Cardano founder predicts https://t.co/OoHgwxRH4m

— CNBC (@CNBC) April 10, 2025

BlackRock Saw the Only Gains Among Nine ETH ETFs

On April 10, five Ethereum ETFs were active. BlackRock Ethereum ETF (ETHA) had the only gains worth $6.43 million, while the remaining four active funds experienced outflows. Four other ETFs saw neither inflows nor outflows. Like Bitcoin ETF, Fidelity Ethereum ETF (FETH) topped the losses chart with outflows, valued at approximately $36.01 million.

Other Ethereum ETFs that recorded losses include VanEck Ethereum ETF (ETH), Bitwise Ethereum ETF (ETHW), and Grayscale Ethereum ETF (ETHE). These funds lost $4.44 million, $2.50 million, and $2.27 million, respectively. Following yesterday’s losses, Ethereum ETF cumulative net inflows depreciated from $2.34 billion to $2.32 billion.

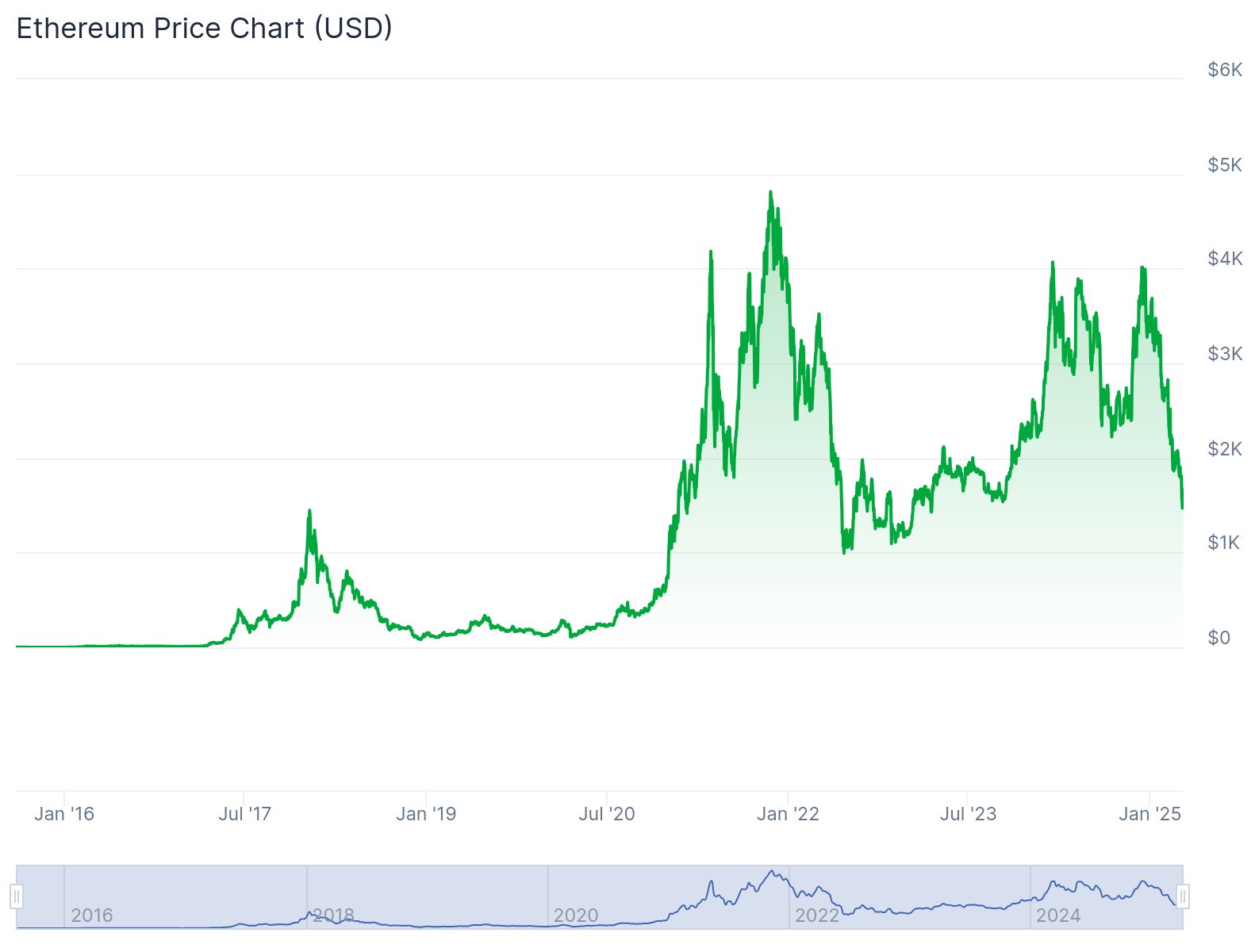

In addition, the total value traded dropped from $823.67 million to $424.11 million. Similarly, total net assets reduced from $5.56 billion to $5.10 billion. The Ethereum ETF net assets valuation represents 2.76% of the token’s $189.77 billion market capitalization. Meanwhile, Ethereum is changing hands at about $1,570, reflecting a 1.5% decline in the past 24 hours. In the past week, ETH dropped 14.2%, with prices fluctuating between $1,417.35 and $1,603.82.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.