Theta Fuel Price Prediction: Will Theta Network Boost TFUEL Price Toward $0.1?

1

0

Theta Fuel (TFUEL) is the main token used for everyday activities and rewards on the Theta network, which is a decentralized system for streaming videos. Theta wants to make video streaming better and more efficient than the traditional platforms we use today. To do this, it uses blockchain technology, special digital tokens, its own custom-built blockchain, and lets the community help run things.

Video streaming is growing really fast all around the world. This is happening because more people have internet access and faster connections. But even with all this growth, the current video streaming systems (which are controlled by a few big companies) still have some problems built into how they work. One big issue that Theta aims to fix is how centralized video streaming is today. Right now, just a few major companies control most of the industry. Because they dominate the space, they can charge high prices and still deliver average or even poor service—since users don’t have many alternatives.

Theta changes this by using blockchain technology to shake things up. It creates a more open and fair system, giving everyday users a better, more affordable option for streaming content. In this article, we’ll analyse Theta Fuel token’s potential and its current market demand. Our Theta Fuel price prediction aims to explore the future forecast of TFUEL token and determine whether it is a good investment option or not.

Theta Fuel: A Quick Introduction

Theta Fuel (TFUEL) is part of the Theta blockchain and works alongside the THETA token, which is used to help govern the network and is supported by many community-run Guardian Nodes. TFUEL is a utility token that powers the decentralized delivery of video and data, and it also acts like a gas token—used to pay for transactions and various operations across the network.

It’s also used to reward people who contribute their internet bandwidth and computing power to support video streaming and data processing.

The main purpose of the Theta platform is to make video streaming, edge computing, and data delivery more decentralized, which helps improve performance, reduce costs, and build more trust among participants.

This setup benefits the entire industry: viewers enjoy better streaming quality and can earn rewards, content creators can increase their earnings, and video platforms save significantly on the cost of building and maintaining their own infrastructure.

The Theta ecosystem was launched in 2017 along with its two tokens. It was founded by Mitch Liu and Jieyi Long.

The team behind the creation of TFUEL includes experienced engineers and media professionals who have worked with major tech companies like Samsung, Netflix, and Amazon. Their strong background and expertise play a major role in helping Theta grow into one of the leading blockchain platforms in the media industry.

How Does TFUEL Work?

Theta uses a range of unique technologies to offer a cheaper and more secure alternative for video streaming and data delivery. It was built on the Ethereum blockchain, which adds an extra layer of security for users. All network nodes use high-level encryption to keep data safe.

One of Theta’s main platforms is Theta.tv, the network’s own streaming service. It allows users to earn rewards for helping support the network. The platform makes it easy to upload or watch video content, and it has already formed big partnerships—most notably with Samsung. In fact, Theta.tv is expected to come pre-installed on future Galaxy devices.

The Theta blockchain was created specifically to meet the needs of the growing video streaming industry. It’s the first full system for decentralized video streaming to gain real traction. The network allows nodes to store and share data, acting as peering points, and in return, they earn TFUEL tokens for their contributions.

Theta utilizes a Proof-of-Stake (PoS) consensus mechanism to enhance network scalability and efficiency. Compared to Proof-of-Work (PoW) systems like Bitcoin, PoS networks offer improved performance and lower energy consumption.

The consensus process involves two tiers of nodes. A select group known as the validator committee is responsible for the initial approval of transactions. These transactions are then finalized by a broader group of nodes called the guardian pool, ensuring additional security and consensus.

Theta Fuel was introduced to the market in 2018. The project launched successfully with a $20 million private token sale, which provided crucial funding for Theta Labs, a San Francisco-based company. This investment supported the development of Theta’s next-generation video streaming protocol and enabled the transition from the Ethereum network to a custom-built Theta blockchain.

How to Become a Validator?

To become a validator on the Theta blockchain, individuals must operate a Guardian Node with a minimum stake of 1,000 THETA tokens, earning TFUEL as rewards. Enterprise Validator Nodes require a significantly higher stake of 1 million THETA tokens. Both THETA and TFUEL are essential to powering the Theta ecosystem.

The Theta network includes three types of validators:

- Enterprise Validator Nodes: Operated by major companies like Google, Samsung, Binance, and Gumi, these nodes stake large amounts of THETA to relay and secure video content on the network.

- Guardian Nodes: Run by community members, these nodes validate and finalize transactions by auditing the work of Enterprise Validators, ensuring network integrity.

- Edge Nodes: Individuals contribute bandwidth and computing power to stream content on Theta.tv. In return, they earn TFUEL, enabling decentralized, peer-to-peer video delivery without relying on traditional CDNs.

TFUEL Historical Price Sentiment

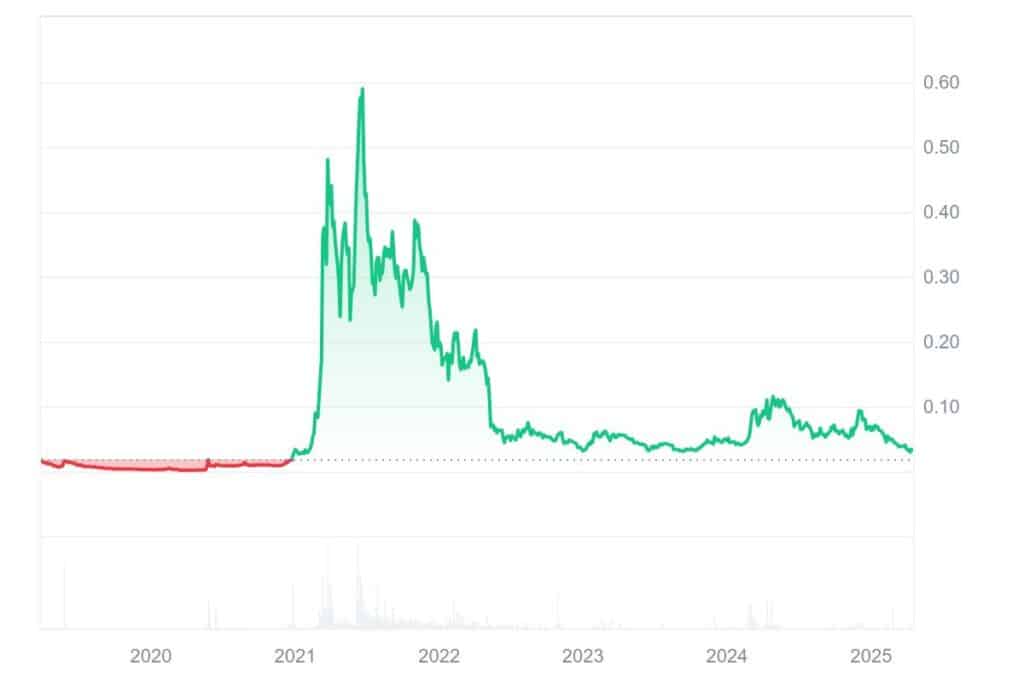

TFUEL entered the market with a price of approximately $0.00971 at the end of June 2019. In the months that followed, the token experienced a steady decline, dropping below $0.005 by early September 2019.

As Theta Labs introduced updates and garnered attention from major partners like Google, Samsung, and Binance, TFUEL began to gain traction. By early 2021, the token surged in response to broader bullish market sentiment and anticipation around Theta Mainnet 3.0, which introduced TFUEL staking and burning mechanics.

During this period, TFUEL reached several local highs and began trading in the $0.10 to $0.50 range, with peak moments pushing it even higher during market rallies.

TFUEL hit its all-time high in June 2021, briefly trading above $0.65 during a surge of interest in altcoins and utility tokens. This surge was also fueled by the success of Theta.tv, a decentralized streaming platform built on the Theta network.

However, as with the rest of the crypto market, TFUEL faced a steep correction later that year, dropping back below $0.30 by the end of 2021.

Throughout 2022 and much of 2023, TFUEL’s price showed bearish market sentiments. It gradually settled into the $0.03 to $0.06 range, as market trends cooled and investors prioritized fundamental-driven projects. Despite this, Theta Labs continued to release technical upgrades and partnerships, helping TFUEL maintain relevance and utility in a crowded space.

TFUEL saw some signs of recovery in early 2024, briefly touching the $0.10 mark again before pulling back amid market consolidation. As of April 2025, TFUEL is trading at approximately $0.03256. This is a 91% surge from its launch price in 2019 and the token continues to play a crucial role in the Theta ecosystem, powering transactions, rewards, and decentralized video delivery.

TFUEL Technical Analysis

Theta Fuel (TFUEL) is currently facing a strong downward pressure as its price dropped sharply after failing to hold at $0.04. Right now, the market is mostly controlled by sellers pushing the price down. Despite this, there is a hint of hope as buyers are starting to show interest in purchasing TFUEL at its current lower prices below $0.03.

The Relative Strength Index (RSI) is at 40, indicating that the bearish momentum is strong. If buyers manage to rally and push the price up towards the descending resistance line, TFUEL could potentially reach a resistance level at $0.04. Breaking past this point might restore market confidence and possibly lead to a rise towards $0.061.

Conversely, if TFUEL fails to stay above the descending trendline, it could face a stronger decline, possibly falling to an important support level at around $0.027. A drop below this could trigger further losses, reinforcing a bearish trend for Theta Fuel.

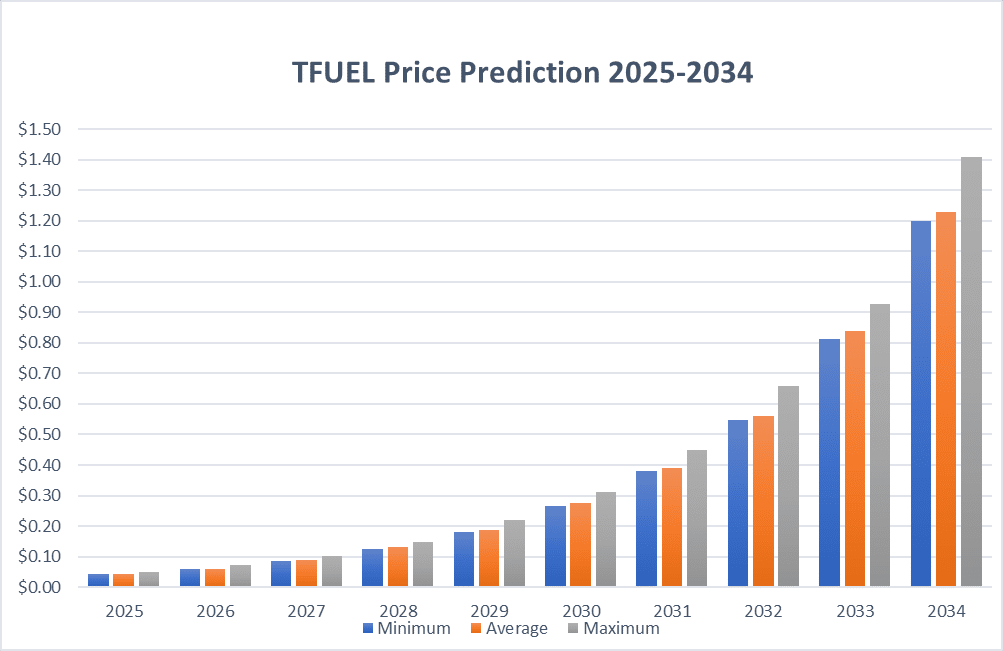

Theta Fuel Price Prediction by Blockchain Reporter

| Years | Minimum ($) | Average ($) | Maximum ($) |

| 2025 | 0.0415 | 0.0431 | 0.0487 |

| 2026 | 0.0592 | 0.0609 | 0.0715 |

| 2027 | 0.0846 | 0.0876 | 0.1022 |

| 2028 | 0.1254 | 0.1298 | 0.1476 |

| 2029 | 0.1821 | 0.1886 | 0.2183 |

| 2030 | 0.2665 | 0.274 | 0.3105 |

| 2031 | 0.3795 | 0.3905 | 0.4486 |

| 2032 | 0.5462 | 0.5619 | 0.6599 |

| 2033 | 0.8124 | 0.8405 | 0.9267 |

| 2034 | 1.2 | 1.23 | 1.41 |

Theta Fuel Price Prediction 2025

In 2025, Theta Fuel (TFUEL) is expected to continue gaining moderate traction as the Theta ecosystem evolves. Analysts anticipate that the price may reach a minimum of around $0.0415 and could climb as high as $0.0487. The average price is forecasted to hover near $0.0431 throughout the year, reflecting steady but cautious growth.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| January | 0.035 | 0.037 | 0.039 |

| February | 0.0356 | 0.0376 | 0.0399 |

| March | 0.0362 | 0.0381 | 0.0408 |

| April | 0.0368 | 0.0387 | 0.0416 |

| May | 0.0374 | 0.0392 | 0.0425 |

| June | 0.038 | 0.0398 | 0.0434 |

| July | 0.0385 | 0.0403 | 0.0443 |

| August | 0.0391 | 0.0409 | 0.0452 |

| September | 0.0397 | 0.0414 | 0.0461 |

| October | 0.0403 | 0.042 | 0.0469 |

| November | 0.0409 | 0.0425 | 0.0478 |

| December | 0.0415 | 0.0431 | 0.0487 |

Theta Fuel Price Prediction 2026

By 2026, TFUEL is projected to show stronger momentum, with price estimates ranging between $0.0592 and $0.0715. The average price during the year is expected to be about $0.0609. This forecast assumes continued adoption of Theta’s video infrastructure and expanded use cases for TFUEL.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| Jan-26 | $0.0422 | $0.0462 | $0.0475 |

| Feb-26 | $0.0454 | $0.0476 | $0.0498 |

| Mar-26 | $0.0472 | $0.0490 | $0.0522 |

| Apr-26 | $0.0487 | $0.0504 | $0.0541 |

| May-26 | $0.0498 | $0.0520 | $0.0567 |

| Jun-26 | $0.0512 | $0.0530 | $0.0593 |

| Jul-26 | $0.0534 | $0.0551 | $0.0619 |

| Aug-26 | $0.0550 | $0.0568 | $0.0641 |

| Sep-26 | $0.0562 | $0.0579 | $0.0669 |

| Oct-26 | $0.0580 | $0.0602 | $0.0698 |

| Nov-26 | $0.0603 | $0.0620 | $0.0729 |

| Dec-26 | $0.0615 | $0.0633 | $0.0760 |

Theta Fuel Price Prediction 2027

Looking ahead to 2027, Theta Fuel may experience increased demand driven by decentralized media platforms and content delivery innovation. Predictions suggest a minimum price of $0.0846 and a potential high of $0.1022, with the average expected near $0.0876 for the year.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| Jan-27 | $0.0601 | $0.0664 | $0.0683 |

| Feb-27 | $0.0666 | $0.0691 | $0.0717 |

| Mar-27 | $0.0680 | $0.0712 | $0.0751 |

| Apr-27 | $0.0709 | $0.0740 | $0.0780 |

| May-27 | $0.0723 | $0.0755 | $0.0809 |

| Jun-27 | $0.0760 | $0.0785 | $0.0847 |

| Jul-27 | $0.0776 | $0.0801 | $0.0878 |

| Aug-27 | $0.0808 | $0.0833 | $0.0918 |

| Sep-27 | $0.0841 | $0.0866 | $0.0960 |

| Oct-27 | $0.0858 | $0.0884 | $0.1003 |

| Nov-27 | $0.0887 | $0.0919 | $0.1039 |

| Dec-27 | $0.0930 | $0.0956 | $0.1075 |

Theta Fuel Price Prediction 2028

TFUEL could enter a more mature phase in 2028, potentially reflecting broader adoption of Web3 streaming solutions. Price forecasts suggest a range between $0.1254 and $0.1476, with an average around $0.1298. These figures indicate strong long-term potential if Theta’s network scales effectively.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| Jan-28 | $0.0917 | $0.1003 | $0.1032 |

| Feb-28 | $0.0976 | $0.1023 | $0.1072 |

| Mar-28 | $0.1016 | $0.1054 | $0.1123 |

| Apr-28 | $0.1037 | $0.1075 | $0.1176 |

| May-28 | $0.1060 | $0.1108 | $0.1230 |

| Jun-28 | $0.1082 | $0.1130 | $0.1274 |

| Jul-28 | $0.1137 | $0.1175 | $0.1319 |

| Aug-28 | $0.1174 | $0.1222 | $0.1366 |

| Sep-28 | $0.1199 | $0.1246 | $0.1427 |

| Oct-28 | $0.1258 | $0.1296 | $0.1490 |

| Nov-28 | $0.1300 | $0.1348 | $0.1555 |

| Dec-28 | $0.1327 | $0.1375 | $0.1622 |

Theta Fuel Price Prediction 2029

In 2029, TFUEL is anticipated to build further on its utility, with prices potentially ranging from $0.1821 at the low end to $0.2183 at the high. The token could maintain an average price of $0.1886, assuming continued growth in decentralized content infrastructure and user participation.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| Jan-29 | $0.1320 | $0.1444 | $0.1485 |

| Feb-29 | $0.1404 | $0.1473 | $0.1557 |

| Mar-29 | $0.1462 | $0.1517 | $0.1616 |

| Apr-29 | $0.1509 | $0.1577 | $0.1692 |

| May-29 | $0.1572 | $0.1641 | $0.1755 |

| Jun-29 | $0.1621 | $0.1690 | $0.1837 |

| Jul-29 | $0.1689 | $0.1757 | $0.1921 |

| Aug-29 | $0.1773 | $0.1828 | $0.1992 |

| Sep-29 | $0.1809 | $0.1864 | $0.2065 |

| Oct-29 | $0.1884 | $0.1939 | $0.2158 |

| Nov-29 | $0.1948 | $0.2016 | $0.2255 |

| Dec-29 | $0.2028 | $0.2097 | $0.2336 |

Theta Fuel Price Prediction 2030

The year 2030 could be pivotal for TFUEL, particularly if decentralized video delivery becomes mainstream. Forecasts place the price between $0.2665 and $0.3105, with an average of approximately $0.2740.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| Jan-30 | $0.2013 | $0.2202 | $0.2265 |

| Feb-30 | $0.2141 | $0.2246 | $0.2353 |

| Mar-30 | $0.2186 | $0.2291 | $0.2443 |

| Apr-30 | $0.2232 | $0.2337 | $0.2557 |

| May-30 | $0.2325 | $0.2430 | $0.2674 |

| Jun-30 | $0.2422 | $0.2527 | $0.2771 |

| Jul-30 | $0.2473 | $0.2578 | $0.2872 |

| Aug-30 | $0.2524 | $0.2629 | $0.3001 |

| Sep-30 | $0.2630 | $0.2734 | $0.3133 |

| Oct-30 | $0.2739 | $0.2844 | $0.3269 |

| Nov-30 | $0.2824 | $0.2929 | $0.3383 |

| Dec-30 | $0.2912 | $0.3017 | $0.3500 |

Theta Fuel Price Prediction 2031

With ongoing innovation and potential institutional interest in Web3 infrastructure, TFUEL may reach prices between $0.3795 and $0.4486 by 2031. An average price of $0.3905 is projected, indicating strong confidence in the token’s utility and role within the Theta network.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| Jan-31 | $0.2866 | $0.3168 | $0.3258 |

| Feb-31 | $0.3080 | $0.3231 | $0.3417 |

| Mar-31 | $0.3240 | $0.3361 | $0.3546 |

| Apr-31 | $0.3307 | $0.3428 | $0.3680 |

| May-31 | $0.3444 | $0.3565 | $0.3818 |

| Jun-31 | $0.3515 | $0.3636 | $0.3960 |

| Jul-31 | $0.3558 | $0.3709 | $0.4142 |

| Aug-31 | $0.3632 | $0.3783 | $0.4290 |

| Sep-31 | $0.3738 | $0.3859 | $0.4442 |

| Oct-31 | $0.3892 | $0.4013 | $0.4635 |

| Nov-31 | $0.3973 | $0.4093 | $0.4835 |

| Dec-31 | $0.4054 | $0.4175 | $0.4999 |

Theta Fuel Price Prediction 2032

In 2032, Theta Fuel could experience a notable price expansion. Predictions suggest a minimum price of $0.5462, with highs potentially reaching $0.6599. The average is forecasted to be around $0.5619.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| Jan-32 | $0.3966 | $0.4384 | $0.4509 |

| Feb-32 | $0.4392 | $0.4559 | $0.4685 |

| Mar-32 | $0.4533 | $0.4742 | $0.4867 |

| Apr-32 | $0.4675 | $0.4884 | $0.5057 |

| May-32 | $0.4822 | $0.5030 | $0.5252 |

| Jun-32 | $0.4973 | $0.5181 | $0.5503 |

| Jul-32 | $0.5222 | $0.5389 | $0.5763 |

| Aug-32 | $0.5288 | $0.5496 | $0.6032 |

| Sep-32 | $0.5549 | $0.5716 | $0.6307 |

| Oct-32 | $0.5679 | $0.5888 | $0.6593 |

| Nov-32 | $0.5897 | $0.6064 | $0.6828 |

| Dec-32 | $0.6140 | $0.6307 | $0.7131 |

Theta Fuel Price Prediction 2033

Continued momentum may push TFUEL to new heights by 2033, with estimates placing the token between $0.8124 and $0.9267. The average price could be near $0.8405, supported by expanding partnerships and real-world applications of Theta’s decentralized technologies.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| Jan-33 | $0.5992 | $0.6622 | $0.6811 |

| Feb-33 | $0.6439 | $0.6755 | $0.7076 |

| Mar-33 | $0.6642 | $0.6957 | $0.7414 |

| Apr-33 | $0.6920 | $0.7236 | $0.7762 |

| May-33 | $0.7065 | $0.7380 | $0.8051 |

| Jun-33 | $0.7360 | $0.7676 | $0.8347 |

| Jul-33 | $0.7514 | $0.7829 | $0.8730 |

| Aug-33 | $0.7733 | $0.7986 | $0.9122 |

| Sep-33 | $0.7990 | $0.8305 | $0.9441 |

| Oct-33 | $0.8156 | $0.8471 | $0.9856 |

| Nov-33 | $0.8558 | $0.8810 | $1.02 |

| Dec-33 | $0.8910 | $0.9162 | $1.05 |

Theta Fuel Price Prediction 2034

Looking toward 2034, TFUEL is forecasted to break the $1.00 mark, with potential lows around $1.20 and highs up to $1.41. The average price is expected to settle around $1.23, signaling robust long-term prospects for investors.

| Months | Minimum ($) | Average ($) | Maximum ($) |

| Jan-34 | $0.8796 | $0.9621 | $0.9895 |

| Feb-34 | $0.9543 | $0.9909 | $1.04 |

| Mar-34 | $0.9649 | $1.01 | $1.09 |

| Apr-34 | $1.00 | $1.04 | $1.14 |

| May-34 | $1.05 | $1.08 | $1.18 |

| Jun-34 | $1.06 | $1.10 | $1.23 |

| Jul-34 | $1.09 | $1.14 | $1.29 |

| Aug-34 | $1.15 | $1.18 | $1.35 |

| Sep-34 | $1.17 | $1.22 | $1.40 |

| Oct-34 | $1.22 | $1.26 | $1.47 |

| Nov-34 | $1.23 | $1.28 | $1.52 |

| Dec-34 | $1.29 | $1.33 | $1.58 |

TFUEL Price Forecasts: By Experts

According to the latest Theta Fuel (TFUEL) price prediction from Coincodex, the token is expected to decline by approximately 1.66%, reaching around $0.031914 by May 15, 2025.

Technical indicators currently reflect a bearish market sentiment, and the Fear & Greed Index stands at 38, indicating prevailing fear among investors. Over the past 30 days, Theta Fuel has recorded 15 out of 30 green trading days and exhibited a price volatility of 8.69%.

Given these conditions, Coincodex suggests that now may not be an ideal time to invest in Theta Fuel, as short-term performance appears uncertain.

According to projections from Digital Coin Price, Theta Fuel (TFUEL) is expected to begin the year 2027 at approximately $0.0954 and trade around $0.12 as the year progresses. Analysts view this as a significant increase compared to the token’s performance in the previous year. Digital Coin Price considers this growth to be a strong and acceptable upward trend for Theta Fuel, indicating positive market sentiment and potential for continued momentum.

Theta Fuel (TFUEL) is expected to reach a minimum price of $0.61 in 2034, with the potential to climb to a maximum of $0.63. The average projected price for the year is also around $0.61.

Analysts suggest that if market conditions remain favorable, TFUEL could surpass its previous highs and move toward a new resistance level. However, they also caution that there is still potential for downward movement if broader market trends shift, indicating that the outlook, while bullish, remains dependent on overall market stability.

Is TFUEL a Good Investment? When to Buy?

It’s tough to say at the moment. TFUEL has been going through a rough patch recently, but there’s no clear way to know when or if that trend will turn around. Also, it’s important to note that while the Theta Network has a whitepaper, Theta Fuel itself doesn’t have one specifically. It is advised to invest in TFUEL at a price of $0.03 for a profitable return in the long term.

In any case, make sure to do your own research before deciding whether or not to invest in Theta Fuel.

Difference Between Theta and Theta Fuel

TFUEL: TFUEL is the primary utility token of the Theta blockchain. It enables users to interact with various features of the Theta network. Users earn TFUEL by sharing their computing resources, such as bandwidth and processing power. The token is also actively traded on major cryptocurrency exchanges. Unlike some cryptocurrencies, TFUEL does not have a fixed supply and is continuously issued as part of the network’s reward system.

THETA: THETA serves as the governance token of the Theta Network. It can be staked to earn rewards and gives holders the power to influence the network’s future through proposals. These proposals are voted on by the community, and if approved, receive support from the community vault. The total supply of THETA is capped at 1 billion tokens.

Conclusion

In conclusion, having two separate tokens—THETA and TFUEL—makes a lot of sense for the Theta Network. It allows each token to serve a clear and specific purpose: THETA is used for staking and securing the network, while TFUEL handles day-to-day operations and transactions. This separation helps keep the network both efficient and secure.

It also prevents potential security issues. If the same token were used for both staking and network operations, someone could try to buy up large amounts of it on the open market and gain too much control. By splitting these roles between two tokens, Theta ensures better stability and protection for its ecosystem.

The rapid growth of the video streaming industry has made platforms like Theta an increasingly attractive choice for users. These decentralized networks offer censorship-resistant alternatives to traditional services, while also delivering lower fees and better performance. As a result, it’s likely that more video content will start appearing on the Theta Fuel-powered network in the near future.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.