Bitcoin Price Bull Run Imminent – All You Need To Know

0

0

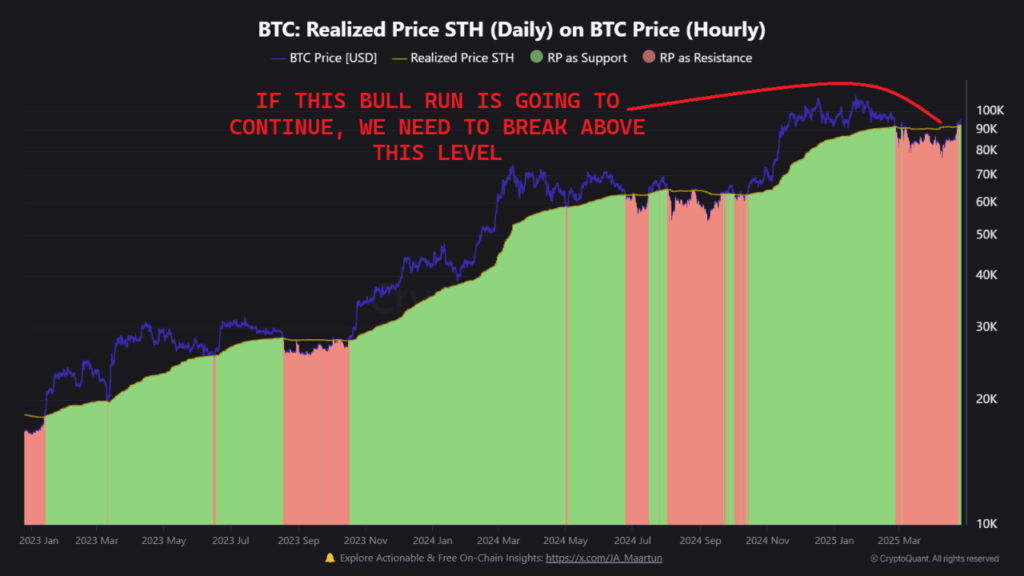

Bitcoin’s price has approached the STH-Realized Price, an important level for confirming the start of a bull run. The STH-Realized Price, which tracks the average price at which short-term holders bought Bitcoin, acts as a key benchmark. For a bull run to gain momentum, Bitcoin price must stay above this level.

Analysts explain this to mean that when the market price is still below this STH-Realized Price, it indicates hesitation of new buyers. For traders, this time is often spent maintaining hedge positions that will guard against risk. However, once Bitcoin (BTC USD) breaks above this threshold, many plan to close their hedges and continue with their spot investments.

The probability of a bull trend is supported by premiums, funding rates, and option market behavior. Early signs of bullish momentum building are positive premiums and prices being above Max Pain levels in the options market. Meanwhile, market watchers are closely watching for whether the STH-Realized Price will confirm next move.

Net Realized Profit and Loss (NRPL) Supports Bullish Outlook

Analysis of Bitcoin’s Net Realized Profit and Loss (NRPL) metric suggests that the market has cooled and may be ready for a new rally. NRPL is a net profit or loss realized by investors on the net. Recent readings indicate that Bitcoin price has exited an overheated phase and formed a bottom signal.

This represents a shift in the NRPL data which contains a signal that investors are climbing down from previous losses. There has been a formation of a more positive sentiment, which is a good premise for price rise. According to the experts, there is still a possibility of a minor short term correction, but the bigger picture is set up for upwards movement.

According to data from CoinGlass, there is strong seller interest in the range of $97,000 to $100,000. Bitcoin’s price may rise to this level to capture available liquidity before experiencing a pullback. The presence of large sell orders around $100,000 suggests that volatility could increase as Bitcoin tests these resistance levels.

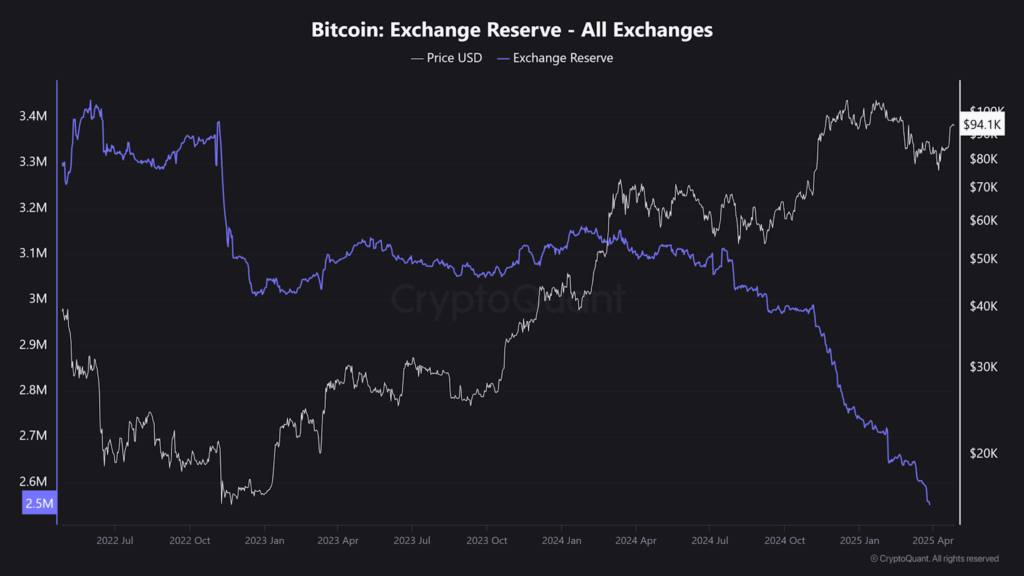

Bitcoin (BTC USD) Exchange Supply Falls to Lowest Since 2019

The supply of Bitcoin held on centralized exchanges has dropped to its lowest point since 2019. According to data from CryptoQuant only some 2.5 million BTC are left on exchanges with the number having fallen by almost 500,000 coins since the end of 2024. This trend indicates that investors are moving their Bitcoin into private wallets.

In the shift towards self custody, some holders indicated their intention to hold on to their assets for longer than they would sell them. Generally, the reduction of available supply on exchanges will indicate reduced selling pressure. The potential of a supply crunch builds as the more coins get taken off exchanges.

The trend of moving Bitcoin off exchanges began in early 2023 when reserves stood at approximately 3.2 million BTC. In the past year, the pace has quickened, partly due to burning interest among institutions.

Institutional Demand and Potential Supply Crunch

Institutional investors have played a large role in the ongoing reduction of Bitcoin supply on exchanges. Firms such as Fidelity have made large purchases, with Fidelity alone recently buying $253 million worth of Bitcoin (BTC USD). This buying pressure contributes to the steady outflow of Bitcoin from public trading platforms.

Dennis Porter said,

“We have never seen this before. We have never had a global Bitcoin supply crunch.”

Given the shrinking available supply coupled with strong demand, such conditions could be favorable for further price increases.

According to Coinbase, more than three quarters of institutional investors intend to boost digital asset holdings by 2025. Many are using Bitcoin as a tool for portfolio diversification and protection against macroeconomic risks.

Publicly traded companies have also been aggressive in Bitcoin accumulation. Over 425,000 BTC is withdrawn from exchanges, with over 350,000 BTC under publicly listed firms’ possession since November 2024.

The post Bitcoin Price Bull Run Imminent – All You Need To Know appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.