Arthur Hayes Predicts Bitcoin Could Reach $1 Million by 2028 with Increased U.S. Liquidity

0

0

Highlights:

- Hayes forecasts Bitcoin could reach $1 million by 2028 if U.S. liquidity increases.

- He warns tariffs and Fed inaction may trigger short-term market volatility and price swings.

- Bitcoin’s exchange reserves hit their lowest levels since 2018 which signals long-term investor confidence.

Former BitMEX CEO and co-founder, Arthur Hayes, has offered another striking prediction for Bitcoin’s future. During his appearance at Token2049 in Dubai, Hayes said Bitcoin might surge to $1 million by 2028. Hayes suggests that if the U.S. increases dollar liquidity through methods like quantitative easing, it may push crypto prices higher.

As more dollars enter the economy, investors may turn to assets like Bitcoin, which Hayes says could rise as high as $1 million. “It’s time to go long everything,” he added, signaling confidence in a broader market rally.

Arthur Hayes delivered a speech at Token2049, predicting that Bitcoin's price will reach $1 million by 2028. He believes the U.S. will need to increase dollar liquidity through measures similar to quantitative easing, which could drive up cryptocurrency prices.…

— Wu Blockchain (@WuBlockchain) April 30, 2025

Hayes Warns of Market Volatility Due to Tariffs and Fed’s Inaction

Arthur Hayes said current market uncertainty is mostly due to Donald Trump’s push for high tariffs. These tariffs have been delayed for 90 days, but concerns remain. Hayes also noted that Fed Chair Jerome Powell may avoid direct action for now. This situation could lead to short-term price swings in the market.

Hayes talked about how rising interest rates and other issues in mid-2022 made markets unstable. He also mentioned the fall of FTX during that time, which hurt trust in crypto. Despite the challenges, the U.S. injected $2.5 trillion into the financial system via its repo program to stabilize the economy. Hayes emphasized that the current market conditions mirror those from that time.

On April 21, Hayes suggested that upcoming US Treasury buybacks could be the next big catalyst for Bitcoin. He believes this could be the “last chance” to buy Bitcoin for under $100,000. Treasury buybacks happen when the US Treasury repurchases its own bonds from the open market. This process helps increase liquidity, manage federal debt, and stabilize interest rates.

Like the Easter bunny, bounce bounce bounce bounce bounce!

Seriously fam, this might be the last chance you have to buy $BTC < $100k

.

New essay drops this week about The BBC Bazooka, treasury buy backs.

Yaxhtzee pic.twitter.com/iYCXqGxsws

— Arthur Hayes (@CryptoHayes) April 21, 2025

Institutional investors seem to be paying closer attention. ARK Invest CEO Cathie Wood mentioned that the likelihood of Bitcoin reaching $1.5 million by 2030 has risen due to its growing adoption by institutions. Wood added that many institutional investors are now looking at Bitcoin as a potential addition to their portfolios. They see its return and risk profile as different from other assets.

We’ve published our bitcoin price forecast through 2030. Read our research from @dpuellARK and share your thoughts.https://t.co/CH7y5EyUjY

— ARK Invest (@ARKInvest) April 24, 2025

Moreover, Bitcoin’s volatility has dropped to a 563-day low. This means Bitcoin’s price is becoming more stable. Research by K33 suggests that Bitcoin is evolving into a more reliable global financial asset.

BTC 7-day volatility hits 563 day low pic.twitter.com/9xvvQ3t6N7

— Vetle Lunde (@VetleLunde) April 30, 2025

Bitcoin Reaches New Milestone with Bullish Data

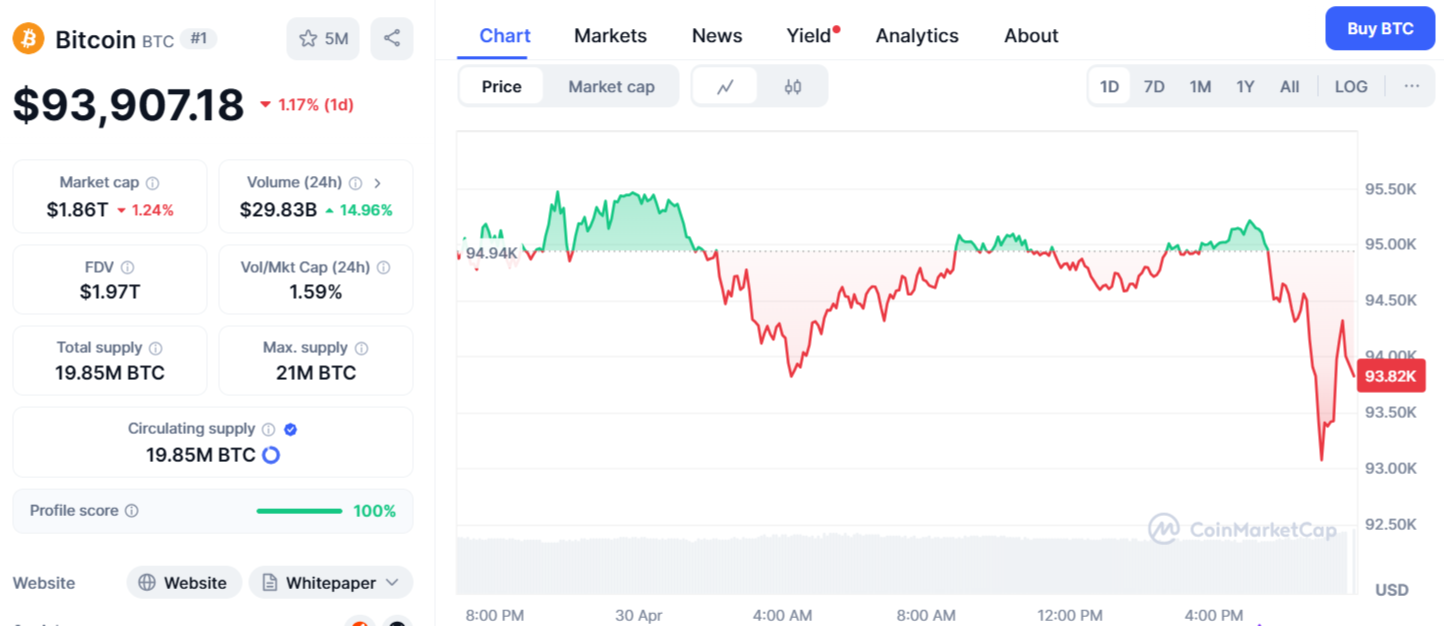

Recently, Bitcoin surpassed Silver and Amazon to become the sixth most valuable asset globally. The cryptocurrency was trading at $93,907, according to CoinMarketCap, with a slight 1.17% decline over the last 24 hours.

On-chain data strengthens the positive outlook, with Bitcoin’s exchange reserves hitting their lowest level since November 2018. These reserves represent the amount of Bitcoin stored on exchanges, and a decrease signals that investors are moving their coins into private wallets. This trend suggests a long-term holding strategy, as traders typically withdraw assets from exchanges to securely store them rather than sell them.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.