3 US Crypto Stocks to Watch Today

0

0

Crypto US stocks showed strong momentum last week, with Strategy Incorporated (MSTR), Core Scientific (CORZ), and Coinbase (COIN) leading the action.

MSTR continues its impressive run with year-to-date gains of 27.3%, while CORZ surged over 25% in the past five days. Meanwhile, COIN is up nearly 20% over the same period despite still being down for the year. Here’s a closer look at each of these three stocks and the key technical levels they are approaching.

Strategy Incorporated (MSTR)

Strategy Incorporated (MSTR) continues to be one of the top-performing crypto-related U.S. stocks in 2025, with year-to-date gains now reaching 27.3%.

It closed last Friday up 5.24% and is trading another 1.84% higher in the pre-market, maintaining strong momentum ahead of a major company update.

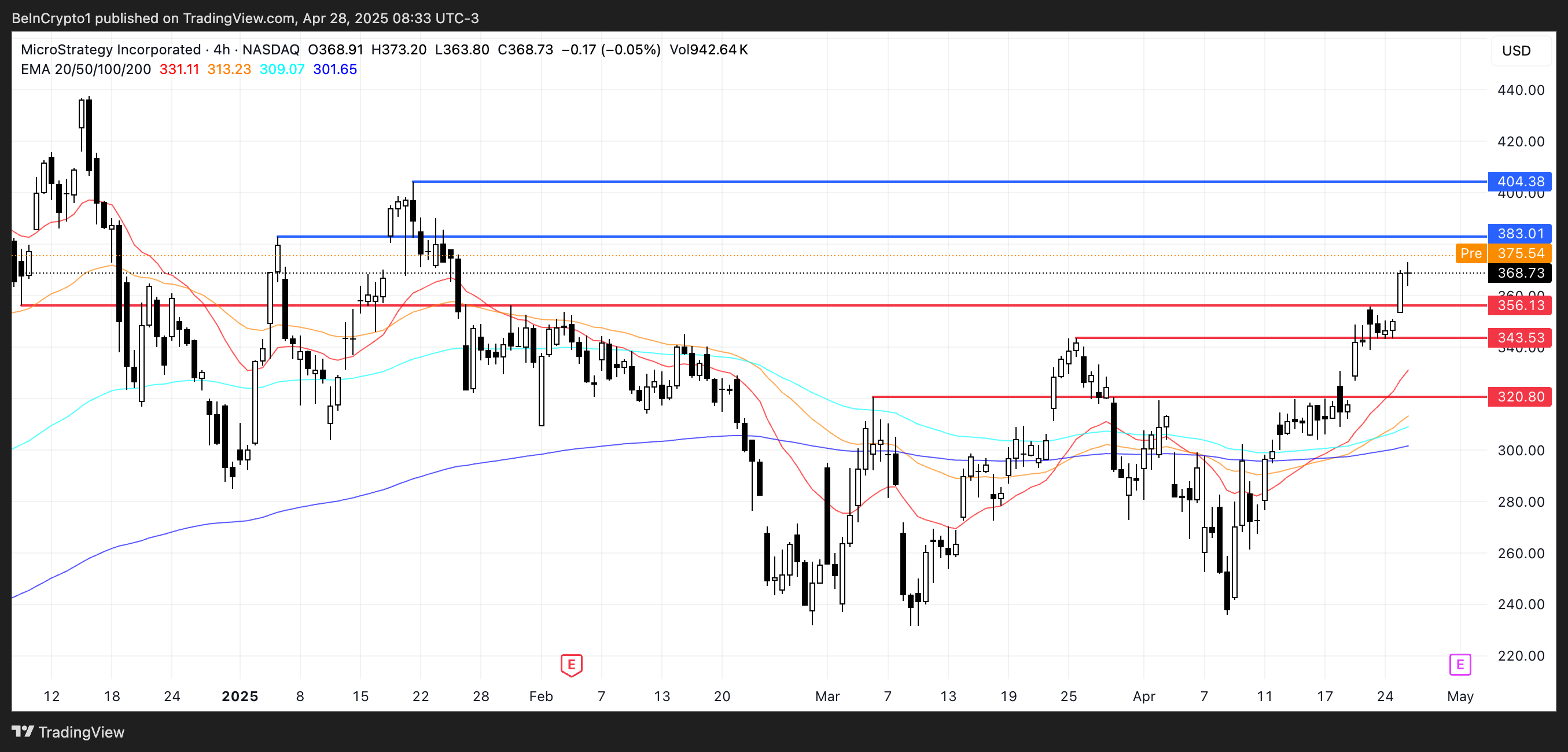

MSTR Price Analysis. Source: TradingView.

MSTR Price Analysis. Source: TradingView.

Strategy Incorporated, led by executive chairman Michael Saylor, is famous for its aggressive Bitcoin accumulation strategy. The company has consistently bought Bitcoin over the years, positioning itself as a software firm and a major proxy for Bitcoin exposure in traditional markets.

Strategy is set to report its earnings on May 1, a key event that could drive additional volatility. Technically, MSTR is facing resistance around $383; if this level is broken, it could rise toward $404.

Its Relative Strength Index (RSI) is currently at 73, signaling overbought conditions, while its Average Directional Index (ADX) sits at 33, confirming a strong ongoing uptrend.

Core Scientific (CORZ)

Core Scientific (CORZ) was the best-performing crypto US stock last Friday, closing with strong gains of around 10.36% — one of its largest 24-hour performances this year.

Over the past five days, CORZ has surged more than 25%, highlighting renewed bullish momentum for one of the market’s most prominent Bitcoin mining companies.

CORZ Price Analysis. Source: TradingView.

CORZ Price Analysis. Source: TradingView.

Core Scientific operates as a major Bitcoin mining firm, providing large-scale blockchain infrastructure and hosting solutions for digital asset mining.

CORZ is up another 0.60% in the pre-market today and recently broke through a key resistance at $7.99. It could soon test the $8.49 level if the current momentum persists.

Technical indicators also point to a potential golden cross forming in the coming sessions, and if confirmed, CORZ could rally further toward $9.45.

Coinbase (COIN)

Coinbase (COIN) closed last Friday with a 2.83% gain but is showing little movement in the pre-market, up just 0.02%.

Despite today’s slow start, COIN is up nearly 20% over the last five days, although it remains down 15.5% for the year.

Coinbase operates as one of the largest cryptocurrency exchanges in the United States, offering trading, custody, and staking services for a wide range of digital assets.

COIN Price Analysis. Source: TradingView.

COIN Price Analysis. Source: TradingView.

Technically, COIN recently broke through resistance around $206.5 and is now aiming to test the next major level at $226.

The bullish outlook is supported by a newly formed golden cross, which could help drive further upside momentum in the sessions ahead.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.